The 25-Second Trick For Clark Wealth Partners

Clark Wealth Partners Can Be Fun For Anyone

Table of ContentsHow Clark Wealth Partners can Save You Time, Stress, and Money.The 7-Second Trick For Clark Wealth PartnersSome Known Details About Clark Wealth Partners What Does Clark Wealth Partners Mean?Not known Facts About Clark Wealth PartnersAll About Clark Wealth PartnersWhat Does Clark Wealth Partners Do?The Buzz on Clark Wealth Partners

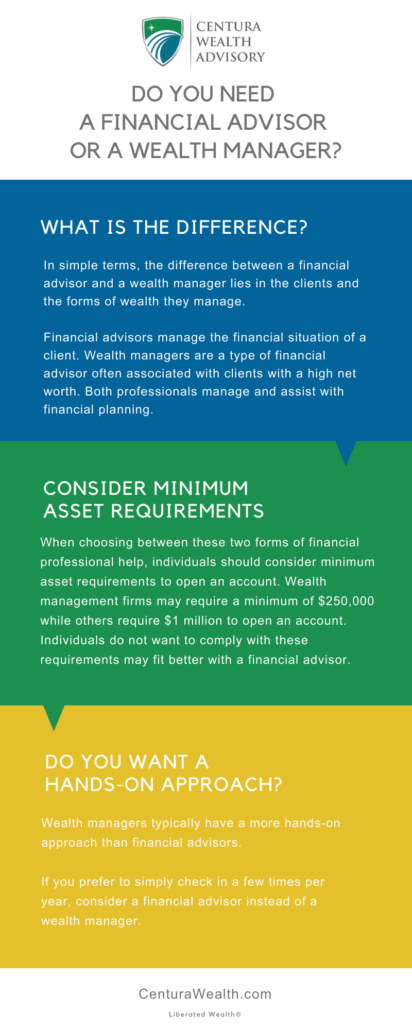

Common factors to take into consideration a monetary expert are: If your monetary circumstance has come to be extra complicated, or you do not have self-confidence in your money-managing skills. Saving or browsing significant life events like marriage, divorce, children, inheritance, or work change that may significantly affect your economic situation. Browsing the transition from conserving for retirement to protecting wide range throughout retired life and exactly how to create a strong retired life revenue strategy.New modern technology has actually resulted in more thorough automated monetary tools, like robo-advisors. It's up to you to investigate and establish the appropriate fit - https://www.tumblr.com/clrkwlthprtnr/801205534898454528/at-clark-wealth-partners-we-believe-balance-is?source=share. Eventually, a good monetary expert must be as mindful of your financial investments as they are with their very own, preventing excessive fees, conserving money on taxes, and being as clear as feasible concerning your gains and losses

Getting My Clark Wealth Partners To Work

Earning a compensation on item referrals doesn't always imply your fee-based expert antagonizes your best interests. Yet they may be more inclined to suggest services and products on which they earn a compensation, which may or might not be in your ideal interest. A fiduciary is lawfully bound to place their client's interests initially.

This common permits them to make referrals for investments and services as long as they fit their client's goals, threat resistance, and financial situation. On the other hand, fiduciary consultants are lawfully obligated to act in their customer's best passion rather than their very own.

10 Easy Facts About Clark Wealth Partners Described

ExperienceTessa reported on all things spending deep-diving right into complex monetary subjects, clarifying lesser-known investment methods, and uncovering methods readers can work the system to their benefit. As a personal financing specialist in her 20s, Tessa is acutely knowledgeable about the effects time and unpredictability have on your investment choices.

It was a targeted ad, and it worked. Find out more Review much less.

The Basic Principles Of Clark Wealth Partners

There's no single route to ending up being one, with some people starting in financial or insurance coverage, while others begin in accountancy. A four-year level gives a strong foundation for careers in financial investments, budgeting, and client solutions.

The Main Principles Of Clark Wealth Partners

Usual examples include the FINRA Series 7 and Series 65 exams for safeties, or a state-issued insurance license for offering life or medical insurance. While credentials might not be legitimately needed for all preparing functions, companies and clients frequently watch them as a standard of professionalism. We check out optional credentials in the next area.

Most monetary coordinators have 1-3 years of experience and knowledge with economic items, conformity standards, and direct customer communication. A solid instructional background is vital, yet experience shows the ability to use theory in real-world settings. Some programs combine both, allowing you to complete coursework while making supervised hours through internships and practicums.

Our Clark Wealth Partners Ideas

Early years can bring lengthy hours, pressure to construct a customer base, and the need to consistently verify your know-how. Financial coordinators delight in the chance to work very closely with clients, guide vital life decisions, and often accomplish flexibility in routines or self-employment.

They invested much less time on the client-facing side of the market. Almost all monetary supervisors hold a bachelor's degree, and several have an MBA or comparable graduate level.

The Definitive Guide for Clark Wealth Partners

Optional accreditations, such as the CFP, usually require additional coursework and screening, which can prolong the timeline by a couple of years. According to the Bureau of Labor Stats, personal monetary experts make an average yearly yearly salary of $102,140, with leading earners gaining over $239,000.

In various other districts, there are policies that need them to fulfill certain demands to utilize the economic advisor or financial coordinator titles. For monetary organizers, there are 3 common designations: Licensed, Individual and Registered Financial Organizer.

Clark Wealth Partners Fundamentals Explained

Where to discover a financial expert will depend on the kind of advice you require. These organizations have staff that may help you recognize and buy specific types of investments.